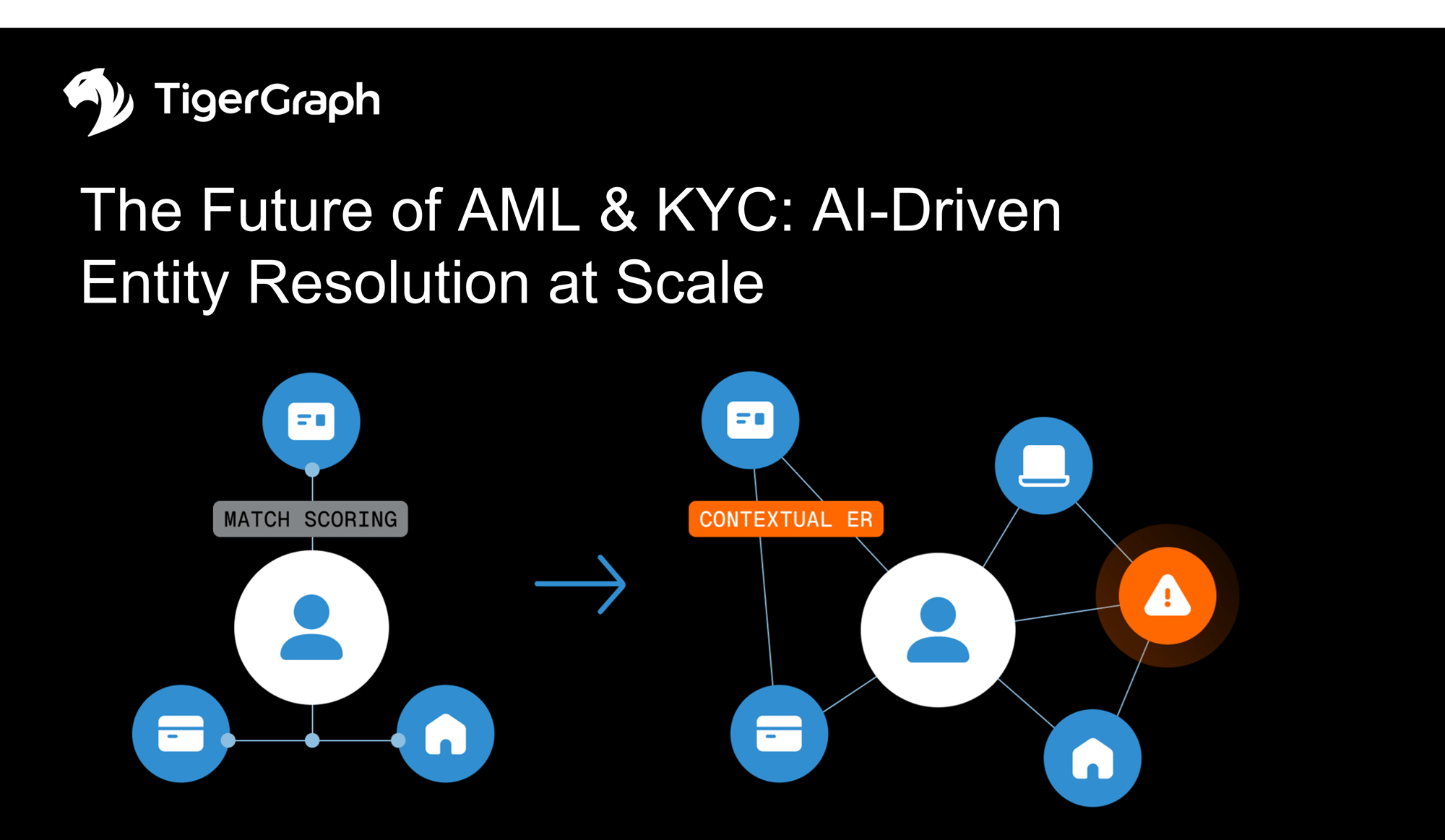

Financial institutions are embracing AI to fight financial crime, but most models are only as good as the data they can connect. Fragmented systems, duplicate identities, and missing context lead to false positives and hidden risks.

See how TigerGraph’s AI-powered graph technology delivers the missing context layer for AML and KYC and unifies data across customers, accounts, devices, and transactions into one trusted identity graph. With graph-enhanced AI and intelligent entity resolution, you can detect hidden relationships, accelerate investigations, and satisfy regulators with explainable results.

Learn how leading enterprises are:

- Use graph + AI to uncover hidden risk networks and reduce false positives

- Build a real-time identity graph that continuously learns and adapts

- Power explainable AI for AML and KYC investigations

- Improve AI accuracy and training with graph-structured features